Getting The Mortgage Broker To Work

Wiki Article

Some Known Factual Statements About Mortgage Broker

Table of ContentsThe Greatest Guide To Mortgage BrokerThe Single Strategy To Use For Mortgage BrokerMortgage Broker - TruthsSome Known Factual Statements About Mortgage Broker The Mortgage Broker IdeasNot known Details About Mortgage Broker Get This Report on Mortgage Broker

Home Mortgage Brokers Aren't Right for Every Residence Buyer My instance may be unique, or it could not. I directly don't know anyone else that's ever made use of a home loan broker to buy a residence.

Are they going to send your finance paperwork? Area concerns from the lender? Choose a closing lawyer? Once again, these are things that are good to understand in advance? This is where I went down the ball. I really did not read any type of online testimonials before I dedicated to dealing with the loan provider. If I had, my house acquiring experience could have been way various.

Mortgage Broker - The Facts

Despite the fact that a broker is intended to aid you discover the most effective price, it does not hurt to see on your own what's around. You could stumble upon a far better offer as well as find that you don't require the broker in any way - mortgage broker.

Not recently, but in the future as well, specifically if rates of interest increase or their circumstances transform. What to expect Typically you will certainly have your interview before sending your mortgage application. Your meeting could occur in one go, or over a couple of much shorter sessions to collect all the needed info.

Get This Report about Mortgage Broker

Don't be placed off by the degree of information the mortgage advisor or loan provider's representative will want to go into. Think of it as an advice session where the mortgage advisor or lending institution is familiar with you - mortgage broker. Eventually the objective is to assist you pick one of the most ideal home mortgage for your present demands and scenarios whilst considering your future plans.Know the responses Part of the meeting's objective is to develop that you'll be a liable consumer as well as to figure out just how much money you'll have available after all your commitments are taken care of as well as exactly how much you can be comfy investing on a home loan. In order to do this, you might be inquired about your monthly expense in the locations below.

These will be gone back to you. Essential expenses This is what you routinely invest in the important things you can refrain without, such as food, gas as well as power as well as various other home heating prices, water bills, telephone, vital travel costs (such as traveling to function or school runs), council tax obligation, buildings insurance (it's a condition of your mortgage that the structure must be guaranteed), ground rental fee and also service costs (for leasehold residential or commercial properties), as well as house cleansing and also washing.

Getting My Mortgage Broker To Work

Settlements and also various other commitments This covers various other settlements you know you will certainly need to make, consisting of financial debts you are paying off, like credit card bills, lendings or employ purchase payments, and kid maintenance as well as alimony repayments. The precise details you are requested will certainly range lenders, but you should anticipate to discuss your routine investing in all these locations.This assists the loan provider determine, based upon your previous borrowing activity, whether you will certainly be able to settle what you owe. Throughout your interview, you'll be asked if you have actually ever had a Region Court Judgment or any other Court Order for non-payment of a financial obligation. If you had, this might be a problem for your application.

Also, you'll be asked if you've ever been in debts for a home loan, rent, finance, charge card or shop card, had a property repossessed, been refused a home loan or credit report. Or if you've ever been proclaimed bankrupt or insolvent. Beginning of deposit Occasionally lenders will would like to know where your down payment is originating from.

Little Known Facts About Mortgage Broker.

Or if you are getting help from your moms and dads or any individual else, you will need a letter from them stating whether the cash is a present or a car loan. Various other concerns A few of the other concerns you could be asked can really feel a little bit personal. Maintain in mind that the lender or home mortgage consultant is merely trying to understand your existing scenario and also how future plans could affect what you can pay for.If this holds true, you'll likewise be asked concerning your pension plan plans. Located this useful?.

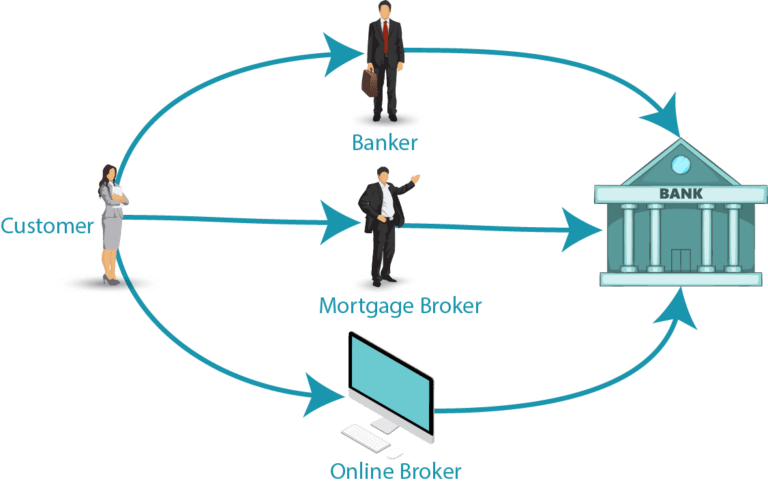

What's so terrific concerning home mortgage brokers? Do you also require one? Let's put it similar to this: the appropriate home loan broker can conserve you a lots of stress and anxiety in addition to potentially numerous extra pounds each month on home mortgage settlements. Intrigued? Read on to have all your questions regarding this mortgage brokers responded to.

The Best Guide To Mortgage Broker

the factor is, it depends on you). Why make use of a home loan broker? why not find out more Making use of the ideal home mortgage broker can make life a heck of a lot easier and also (most likely) cheaper. Here are some of the primary advantages. An independent home mortgage broker will certainly have the ability to search every home loan around to discover you the best deals.Make certain to make use of a broker who is 'whole-of-market' which suggests they can browse every home mortgage. Not all of us recognize what kind of mortgage we should be looking for or which deals we should be avoiding. A mortgage broker is a specialist who'll have the ability to encourage you on the very best means onward given your scenarios.

A home loan broker will certainly be on your side. This means you can be honest with them about your situation without bothering with whether this is going to negatively influence your application. It's their job to hear what you have to claim and afterwards find you a lender that can work with your situations.

What Does Mortgage Broker Do?

This is normally a percentage of the value of your mortgage (usually 0. Don't fret however, the loan provider doesn't bill you more because of it, you still get the very same (as well as in some cases far better) rates using a broker than you would by obtaining a home loan straight from the loan provider.Which is much better a cost-free find here broker or one you have to pay for? As long as you make use of a broker that can search every home loan deal out there, the end outcome need to be the same (in other words you should, fingers crossed, finish up with the finest offer out there).

Report this wiki page